The tax credit is broken down into Provincial and Federal amounts with the Federal portion being the same across the country and the Provincial percentage varying from Province to Province. If you are in one of the target groups listed below an employer who hires you could receive a federal tax credit of up to 9600.

It is not done on all sales as the lots are generally plotted already and there is no need for it most of the time.

. Internal data must be verified in order to ensure accurate data when filling out tax credit surveys. Bottleneck Payroll Language Options English Opciones de idioma Español Our company participates in a federal employment initiative called the Work Opportunity Tax Credit WOTC. When you claim federal tax credits and deductions on your tax return you can change the amount of tax you owe.

Land survey if they do one would be listed in the closing document as an expense. The Earned Income Tax Credit is designed for families with low or moderate incomes. For example if you owe 1000 in federal taxes but are eligible for a 1000 tax credit your net liability drops to zero.

Your preliminary response to the IRS Form 8850 questions below will help determine if. How Credits and Deductions Work. Tax deductions like the standard deduction come off your income reducing it so you calculate your taxes owed on less earnings.

The Child Tax Credit is worth up to 2000 per child and up to 500 per non-child dependent. For the 2020 tax year its worth between 538 and 6660 depending on how many children you have your marital status and how much you make. 52 equal weekly amounts if you are paid weekly.

The Work Opportunity Tax Credit or WOTC is a general business credit provided under section 51 of the Internal Revenue Code Code that is jointly administered by the Internal Revenue Service IRS and the Department of Labor DOL. Payroll records must also be verified. Tax credits are more favorable than tax deductions because they reduce the tax.

Top Bank Account Promotions for January 2022 Avoid Fees and Earn Up to 1500. WOTC Applicant Survey Compass Group is participating in the Work Opportunity Tax Credit WOTC program. Some credits such as the earned income credit are refundable which means that you still receive the full amount of the credit even if the credit exceeds your entire tax bill.

The WOTC is available for wages paid to certain individuals who begin work on or before December 31 2025. According to the findings from the most recent Canadian Survey on Disability CSD one in five Canadians 6. The Work Opportunity Tax Credit WOTC can help you get a job.

Under the Pay As You Earn PAYE system tax credits are spread evenly throughout the year. If you are working for the full year depending on how often you get paid your tax credits will be divided into. Gen Z and Millennials Favor National and Online Banks Survey Shows What Does That Mean for the Future of Credit Unions.

Allred released his survey days after parents began receiving initial payments of this benefit which he supported in the American Rescue Plan. I was raised by a single mom and. 40 of Women Have Less Than 100 in Their Savings Accounts New Survey Finds.

Tax credit survey when applying a job is to credited the tax before the gross income of the pay check. A tax credit survey checks to see if the quality assurance service technical equipment including software systems databases and analytics works properly. Employers may meet their business needs and claim a tax credit if they hire an individual who is in a WOTC targeted group.

New data from the US. A tax credit is a provision that reduces a taxpayers final tax bill dollar-for-dollar. As of 2020 most target groups have a maximum credit of 2400 per eligible new hire but some may be higher.

A tax credit is a dollar-for-dollar reduction of the income tax you owe. We request that you complete the following survey to determine if our company may be eligible for tax credits based on our hiring practices. The Work Opportunity Tax Credit WOTC is a federal tax credit available to employers who invest in American job seekers who have consistently faced barriers to employment.

2 days agoFor your 2021 tax return the cap on the expenses eligible for the credit is 8000 for one child up from 3000 or 16000 up from 6000 for two or. Employers must apply for and receive a. A tax credit differs from deductions and exemptions which reduce taxable income rather than the taxpayers tax bill directly.

A tax credit is an amount of money that taxpayers can subtract dollar for dollar from the income taxes they owe. Their effect is the same as if you had made a tax payment. This program is designed by the federal government to help companies hire more people into the workforce and to retain employees through federal incentives.

Tax credits are government payouts that give extra money to people who need it including those who need help to care for children those who are disabled workers and people on low incomes. The amount of the tax credit available under the WOTC program varies based on the employees target group total hours worked and total qualified wages paid. Tax credits reduce your tax liabilitywhat you owe the IRSafter you have calculated what you owe.

You might be eligible for one or both of them depending on your. DALLAS Congressman Colin Allred TX-32 today released a short survey seeking to learn how the improved and expanded Child Tax Credit will make a difference for North Texas families. 26 equal fortnightly amounts if you are paid fortnightly.

This tax credit may give the employer the incentive to hire you for the job. Tax credit questions become part of the application and applicants view the extra 30 seconds to two minutes that are required to complete the hiring incentive questions as just another step in. There are two types of tax credit child tax credit and working tax credit.

Census Bureaus Household Pulse Survey which shows how parents used the tax-credit payments revealed that 397 of adults with children had difficulty covering expenses. Special equipment personal support etc. Deductions can reduce the amount of your income before you calculate the tax you owe.

Hiring certain qualified veterans for instance may result in a credit of. Parcels outside of town it is more common. Credits can reduce the amount of tax you owe or increase your tax refund and some credits may give you a refund.

Child Tax Credit 2021 Payments How Much Dates And Opting Out Cbs News

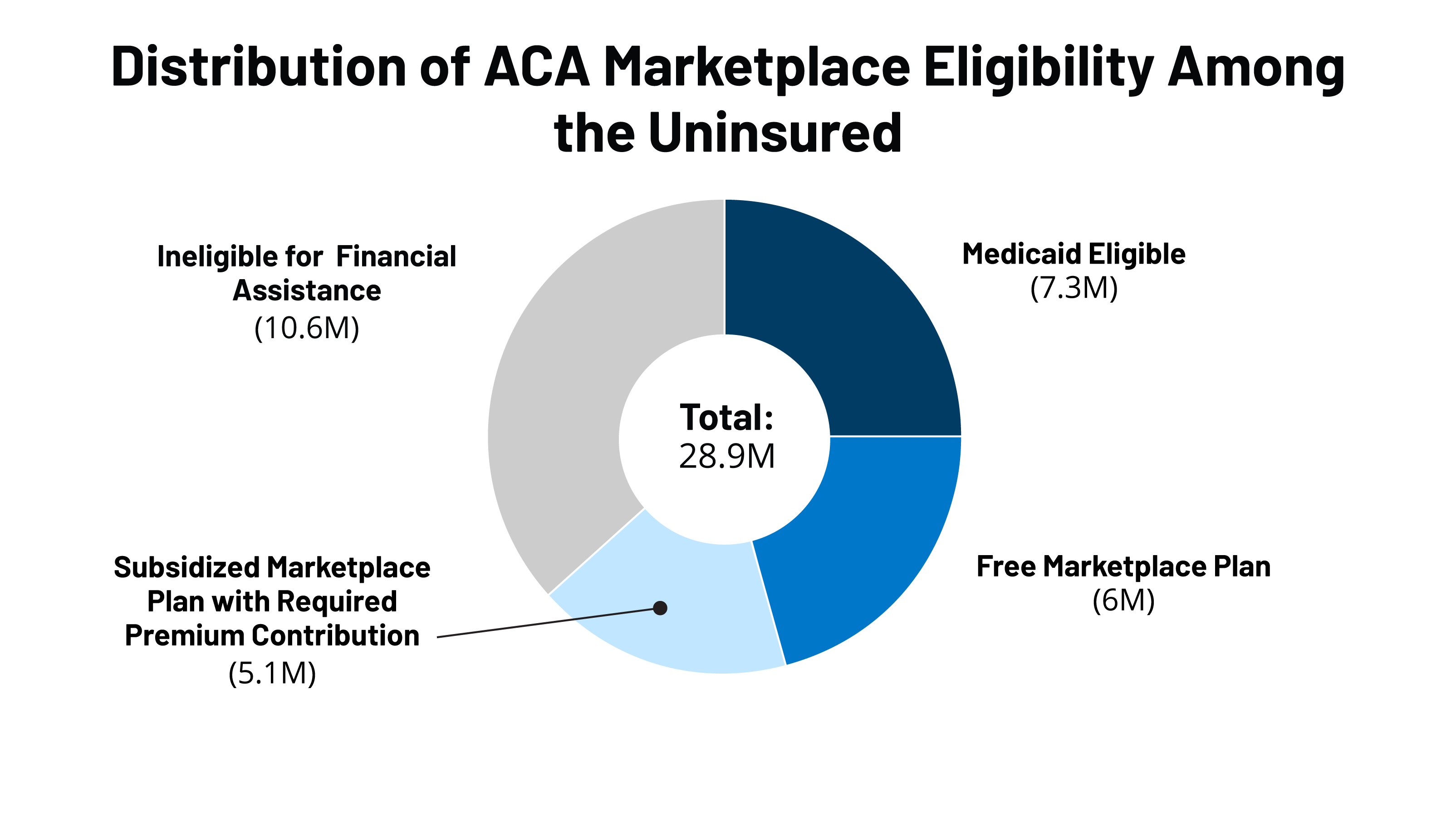

How The American Rescue Plan Act Affects Subsidies For Marketplace Shoppers And People Who Are Uninsured Kff

Work Opportunity Tax Credit What Is Wotc Adp

With Monthly Payments Stalled Congress Needs To Act Center On Budget And Policy Priorities

A Simple Guide To The R D Tax Credit Bench Accounting

How To Claim Student Loan Tax Credits And Deductions Student Loan Hero

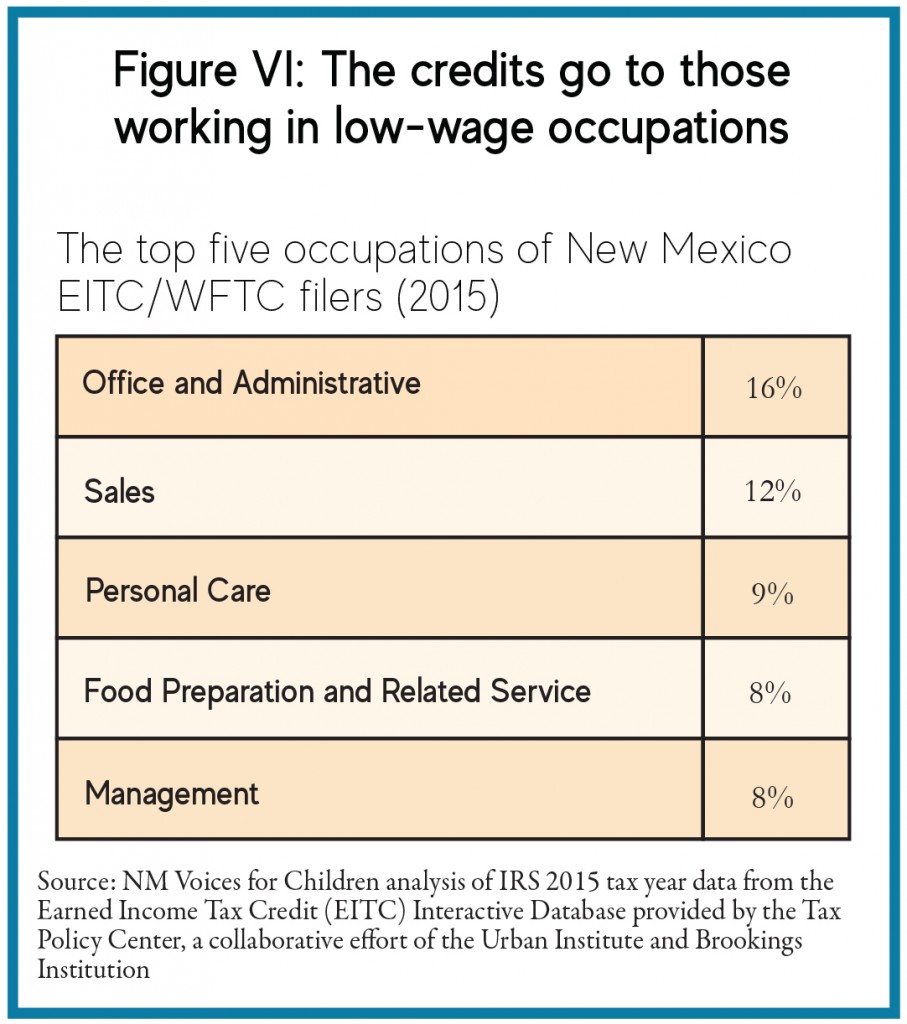

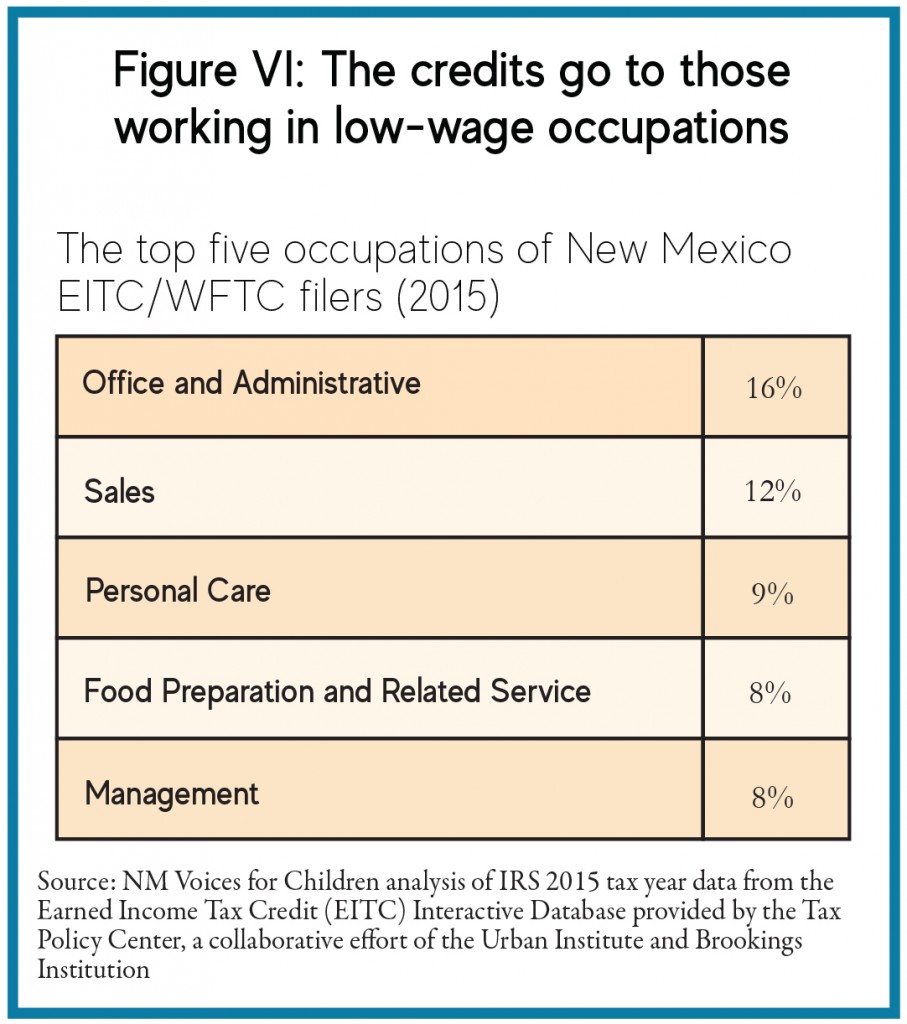

New Mexico S Working Families Tax Credit And The Federal Earned Income Tax Credit New Mexico Voices For Children

New Mexico S Working Families Tax Credit And The Federal Earned Income Tax Credit New Mexico Voices For Children

New Mexico S Working Families Tax Credit And The Federal Earned Income Tax Credit New Mexico Voices For Children

Low Income Housing Tax Credit Ihda

The 2021 Child Tax Credit Implications For Health Health Affairs

The 2021 Child Tax Credit Implications For Health Health Affairs

Work Opportunity Tax Credit What Is Wotc Adp

New Mexico S Working Families Tax Credit And The Federal Earned Income Tax Credit New Mexico Voices For Children

With Monthly Payments Stalled Congress Needs To Act Center On Budget And Policy Priorities

New Mexico S Working Families Tax Credit And The Federal Earned Income Tax Credit New Mexico Voices For Children

Work Opportunity Tax Credit What Is Wotc Adp

Benefits Of Expanding Child Tax Credit Outweigh Small Employment Effects Center On Budget And Policy Priorities